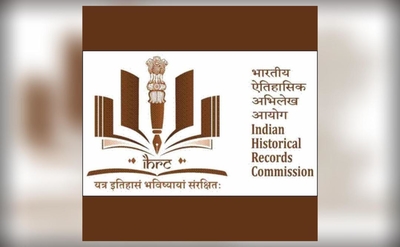

Indian Historical Records Commission (IHRC) Adopts a New Logo and Motto

The Indian Historical Records Commission (IHRC), an apex advisory body on archival matters, acts as an all-India forum of creators, custodians and users of records to advise the Government of India on the management of records and their use for historical research. Established in 1919, the IHRC is headed by the Union Minister of Culture.